Some Known Questions About Bankruptcy Attorney Near Me.

Table of Contents9 Easy Facts About Bankruptcy Information DescribedThe Greatest Guide To Bankruptcy Lawyers Near Me6 Easy Facts About Bankruptcy Attorney DescribedThe 6-Minute Rule for BankruptcyThe Of Bankruptcy BillBankruptcy Attorney Fundamentals Explained

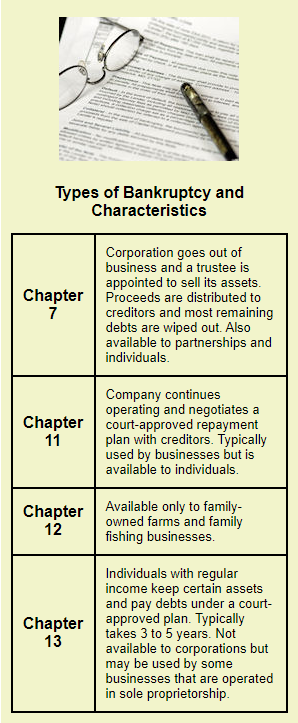

Chapter 13 is often preferable to phase 7 because it allows the borrower to keep a beneficial possession, such as a house and also enables the debtor to propose a "plan" to repay creditors over time usually 3-5 years. Chapter 13 is likewise made use of by consumer debtors who do not receive chapter 7 relief under the means examination.Chapter 13 is really different from chapter 7 considering that the phase 13 debtor typically continues to be in ownership of the property of the estate and also pays to financial institutions, with the trustee, based upon the borrower's awaited revenue over the life of the strategy. Unlike phase 7, the debtor does not receive an immediate discharge of financial obligations, nonetheless.

This magazine reviews the applicability of Phase 15 where a debtor or its building is subject to the regulations of the United States and also one or more foreign nations.

Personal bankruptcy Legislation in the United States is Federal Law under Title 11 of the United States Code. Those are real chapters "in the publication" of the Personal bankruptcy Code, and each Phase pays for distinct stipulations.

Some Known Factual Statements About Bankruptcy Court

In a corporate environment, a Phase 7 insolvency is a liquidation. In an individual Chapter 7 bankruptcy, there is no liquidation of the person.

The majority of people that submit Personal bankruptcy are permitted to maintain every one of their existing home as well as can get credit in the future. There is no minimum quantity of financial debt called for in order to be qualified to apply for Insolvency. All financial obligation should be noted on an Insolvency request. There are lots of extra concerns which we can answer for you in the program of an examination.

If you took a funding to get a lorry as well as can not make your monthly settlements, your car can be repossessed by the loan provider. A typical timespan to be worried concerning foreclosure would be 45-75 days delinquency. There are several

Bankruptcy Attorney Fundamentals Explained

Kid and spousal support obligations and lately incurred revenue tax expenses prevail instances of "nondischargeable debt." And the court won't discharge pupil lendings unless you submit a separate lawsuit as well as meet the requirements to winsomething most individuals can't do. Even if you have nondischargeable financial debt, personal bankruptcy may still be an alternative.

Your state provides the products insolvency filers can safeguard in its personal bankruptcy exception regulations, although some states allow filers use the federal personal bankruptcy exceptions if they would certainly shield extra residential or commercial property. (You need to choose one listing or the otheryou can not utilize exceptions from both lists.) You'll make use of the exact same exemptions in both Chapters 7 as well as 13.

In Phase 7, you 'd lose the nonexempt residential property, and also the trustee selected to handle your instance would offer it and also provide the earnings to your lenders. In Chapter 13, you don't lose nonexempt property. Rather, you have to pay financial institutions what it deserves with the payment plan. Evaluation your state's insolvency exceptions to get a feel for the building you 'd maintain (state web links go to all-time low).

For the bankruptcy bir a lot of bankruptcy lawyers component, services don't submit for Phase 7 or 13. Instead, think about Phase 11 or Phase 11 subchapter V for small organizations.

The 7-Second Trick For Bankruptcy

Getting Chapter 13 isn't ever before straightforward, as well as since of the various challenging policies, you'll want to work with a personal bankruptcy legal representative. Up until then, you can learn about the Phase 13 settlement strategy as well as get an idea concerning whether you make sufficient earnings to cover what you'll have to pay.

It's not perfect, yet it will certainly show you what you should pay (you may have to pay even more). Not long after you submit your "request" or insolvency paperwork, calls, letters, wage garnishments, and also collection suits ought to come to a stop. It occurs since of the "automated remain" order the court quickly implemented.

You'll hand over financial institution statements, paycheck stubs, income tax return, as well as various other papers for the bankruptcy trustee's testimonial. All filers will go to a "341 conference of creditors." At the conference, the trustee will inspect your recognition as well as ask inquiries about your declaring. Lenders can show up and ask concerns as well, but they rarely do.

Usually, after one year you will Resources be discharged from bankruptcy and all of your debts will certainly be created off. Insolvency offers with both protected and unsecured debt.

What Does Bankruptcy Business Do?

In some scenarios, the High Court can make you bankrupt at the request of a financial institution. A creditor can seek for bankruptcy against you if you have actually committed an act of insolvency within the previous 3 months.

As soon as your insolvency begins, you are devoid of debt. The Official Assignee currently owns your possessions and also administers your estate. Your creditors can no much longer look for repayment directly from you. They have to deal directly with the Official Assignee and also all correspondence must be sent to him. You must contribute any kind of excess income to the Official Assignee.

Any individual can examine this register. Find out more in the ISI overview After you are made insolvent (pdf). The Authorities Assignee will certainly bargain an Income Payment Agreement or look for a Revenue Settlement Order for the excess of your revenue over the reasonable living expenses for your scenario, based upon the ISI's standards.

The Main Principles Of Bankruptcy Bill

If you acquire properties after the date when you are made bankrupt (as an example, with inheritance) the Official Assignee can claim them and offer them for the benefit of your lenders. If you have a household house, on your own or with another person, the Official Assignee might just market it with the previous approval of the court.

If you hold residential property collectively (as an example, with your partner) your bankruptcy will cause the joint ownership to be split in between the Official Assignee and also your non-bankrupt co-owner. If the Authorities Assignee has not offered your home within 3 years, ownership might immediately move back to you, unless or else agreed.